See the main points between the S-Corp and C-Corp. If you want to start a business in the US, this guide will show you the main points of discussion between the S-Corporation and C-Corporation so that you can make a more informed decision.

What is an S-Corp?

An S-Corp is a type of corporation that is formed through a tax levy with the IRS. It is the most common type of corporation in the US, accounting for 61% of corporations in the US. S-Corp is nothing more than a variation of C-Corp.

The structure of the corporation is exactly the same as the C-Corp. In this way, shareholders are the people who own the company and make all the important decisions. In addition, they also share the profits of the business. And they can determine the company's future direction.

Your S-Corp also comes with protection from lawsuits. There is no personal liability involved, so if someone sues you, only the corporation's assets are at risk.

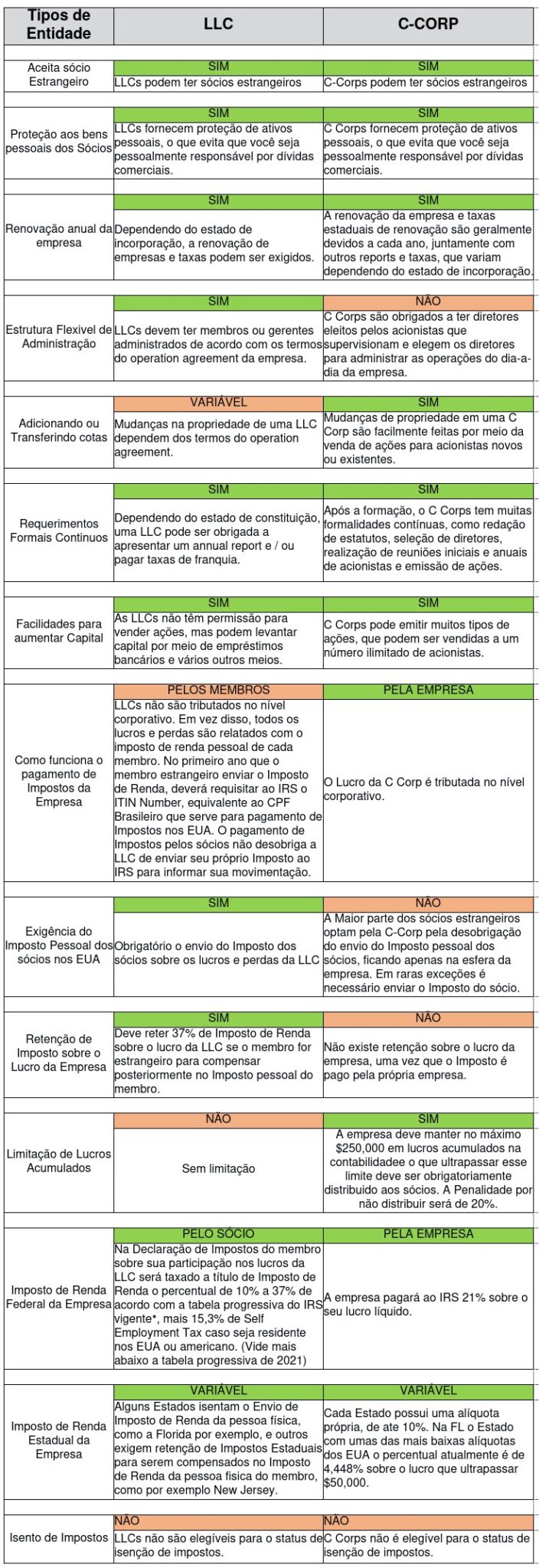

One of the main differences is that only US citizens can form an S-Corp. Foreigners can only form one C-Corp and cannot hold a leadership position in an S-Corp.

In short, there are more similarities than differences between S-Corp and C-Corp.

What is a C-Corp?

C-Corp is the standard business entity for corporations. Whenever you form a corporation, it will initially be a C-Corp until you decide to change it to something like an S-Corp.

As the most common type of corporation, the business is owned by its shareholders. Clear, there can only be one or two shareholders.

It comes with liability protection so if you are sued only the corporation itself is liable rather than the shareholders. This also applies to any business debts that have been written off.

S-corp and C-corp – Understanding the Differences in a Simple Way

Both types of companies have similar ownership rules, but with S-Corp you have restrictions that you don't have with C-Corp.

The main restriction you have is that an S-Corporation can only have 100 shareholders at any one time. That's why you never see an S-Corp appear on the public stock exchange. It's not practical.

C-Corp can have thousands of shareholders. So for companies looking to raise substantial amounts of capital, C-Corp is the only real option.

You also need to remember that an S-Corp can only have US citizens as its shareholders because it is a tax option of the IRS. C-Corps can have as many non-resident shareholders as it wants. In some cases, the entire interest of a C-Corp may be owned by non-US citizens.

Shareholders' rights

The shareholders own the company and with an S-Corp there is only a single class of share whereas with a C-Corp you can have as many levels as you like. This means that whoever owns shares in an S-Corp has the same rights as everyone else. This can produce less flexibility.

C-Corps works in a different way in regards to what stock ownership entitles you to. You may own shares in a C-Corp, but you do not have the right to vote, serve on the board of directors or make decisions within the company. This is because there are many different types of sharing.

A corporation that one day wants to go public will use a C-Corp to protect the founders' holdings and gain more control over new shareholders.

But if you intend to stick to the small business format, S-Corp's voting rights won't have much of an impact going forward.

tax advantages

The difference between a partnership and a corporation often focuses on tax differences. C-Corp is a separate taxable entity by the IRS.

C-Corp is taxed at the corporate level and they have to file a corporate tax return, which is what you would expect. But what you may not know is that money paid to your shareholders can be taxed again at the personal income tax level.

There are ways to limit this form of double taxation, but the point is that it exists and can make entrepreneurs wary of taking money out of the company.

Sometimes it is even profitable to distribute and accept double taxation. It's a balancing act that requires an accountant to work. And it also depends on the state you live in.

How is an S-Corp different?

An S-Corp is not considered a separate taxable entity by the IRS. This is why this form of corporation is considered an elective tax because you are choosing to be taxed at the personal income tax level instead.

Any distributions you receive from the company and any income the company makes are reported as part of your personal income tax return.

This means that S-Corp entrepreneurs are not subject to corporate taxes.

A C-Corp can be taxed at two levels, but if an entrepreneur owns multiple businesses, the C-Corp is a useful entity to reduce your tax bill.

S-Corp vs C-Corp – Which is better for you?

First, you need to consider your ambitions. Big ambitions mean that it's probably better to use a C-Corp because it allows you to operate with a minimum number of shareholder restrictions.

It's also helpful in making sure you preserve your influence within the company. C-Corp is your classic big business level corporation.

- Tax advantages: S-Corp is recommended if you are looking to pay less taxes with a minimum amount of hassle. The only exception is if you own multiple businesses and don't want everything taxed at your personal income level.

- Shareholders – C-Corp is the best option to raise as much capital as possible. You can have as many shareholders as you want and they can come from all over the world.

- Simplicity of Administration – S-Corp is easier to administer than C-Corp as C-Corp is its own taxable entity and has additional responsibilities and obligations.

- non-US citizen – To put it simply, if you are a US citizen, you can choose between the two. But non-US citizens do not have the option of establishing an S-Corp or being a shareholder in one.

For more information on opening an S-Corp or C-Corp contact with America Expert!